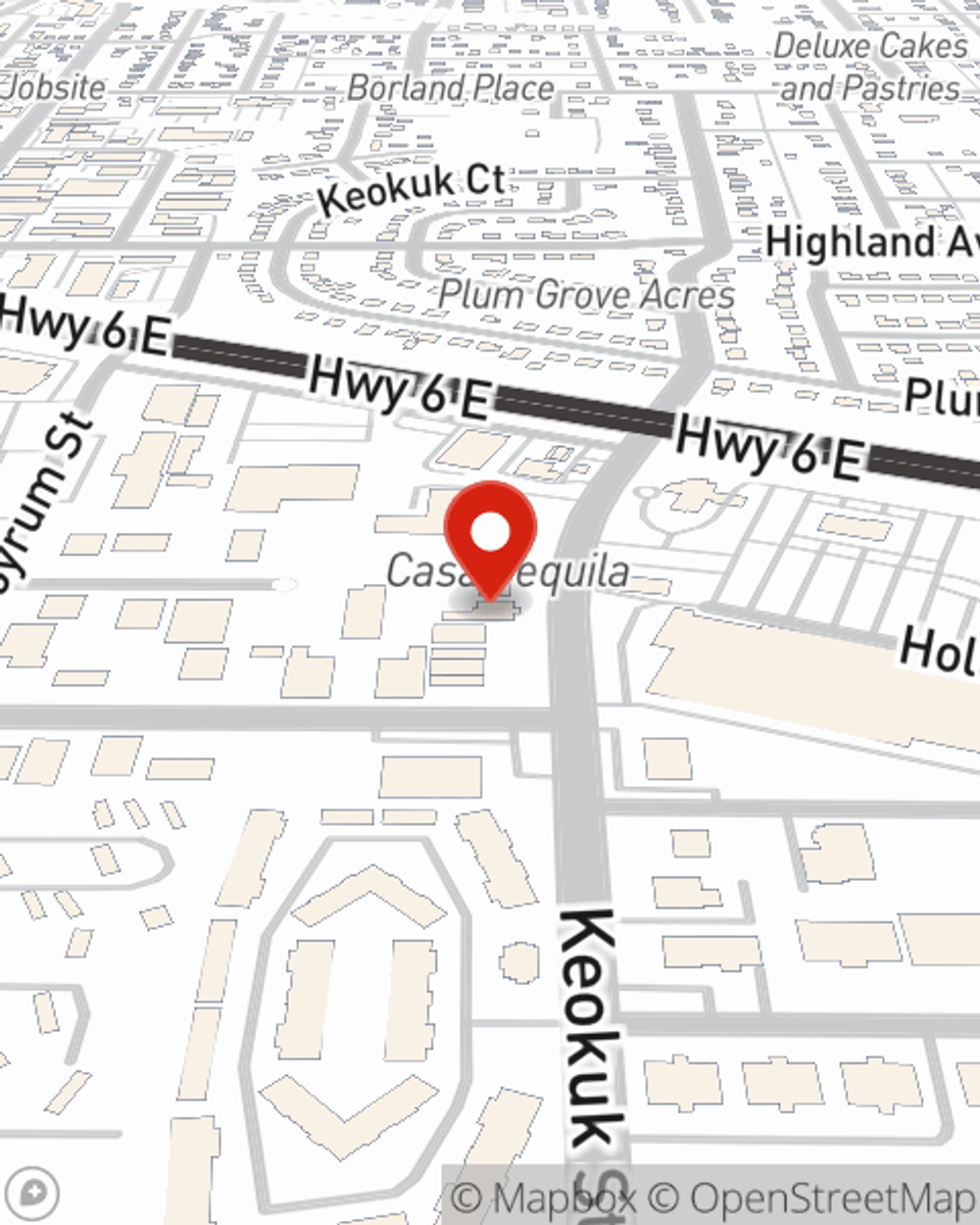

Insurance in and around Iowa City

A variety of coverage options to help meet your needs

Cover what's most important

Would you like to create a personalized quote?

- Iowa

- Illinois

- Minnesota

- Wisconsin

- Eastern Iowa

- Johnson County

- Iowa City

- Western Iowa

- Coralville

- North Liberty

- Tiffin

- Washington

- Solon

- Cedar Rapids

- Williamsburg

- Swisher

- Mount Vernon

- Washington County

- Linn County

- Marion

- Davenport

- Bettendorf

- Quad Cities

- Des Moines

Tried And True Insurance Customizable To Fit You

We can help you create a Personal Price Plan® to help protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, construct your coverage to meet your distinct needs. Contact Chad Burtch for a Personalized Price Plan.

A variety of coverage options to help meet your needs

Cover what's most important

Protect Your Family, Autos, Home, And Future

Some of these great options include Auto, Homeowners, Business and Health insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.

Chad Burtch

State Farm® Insurance AgentSimple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.